E-INVOICING INITIATIVE AND TAX IMPLICATION IMPACT ON BUSINESSES

Upcoming Events:

RM54 nett

per participant

Registration: With immediately effect, registration for this sharing session will be STRICTLY VIA ONLINE REGISTRATION ONLY

* Fee includes service tax.

22 May 2025 (9.30am – 12pm)

Wezmart International Berhad – bpoSA360 Digital Workspace

25, Jln Puteri 7/15, Bandar Puteri, 47100 Puchong, Selangor, Malaysia

E-INVOICING INITIATIVE AND TAX IMPLICATION – IMPACT ON BUSINESSES (MANDARIN SPEAKING)

24 April 2025 (9.30am – 12pm)

Wezmart International Berhad – bpoSA360 Digital Workspace

25, Jln Puteri 7/15, Bandar Puteri, 47100 Puchong, Selangor, Malaysia

E-INVOICING INITIATIVE AND TAX IMPLICATION – IMPACT ON BUSINESSES (MANDARIN SPEAKING)

WHAT’S e-INVOICE?

An electronic invoice refers to a payment voucher issued, received, and stored electronically in the process of purchasing and selling goods, providing or accepting services, and conducting other business activities. In the near future, the government will fully implement the electronic invoice system, replacing forms such as paper or electronic documents, such as invoices, return vouchers, and additional expense vouchers.

The implementation of electronic invoices will also have a profound impact on tax management. Through the electronic invoice system, the government can more efficiently supervise the transaction process, reducing the possibility of tax evasion and avoidance. The digital nature of electronic invoice records also enables tax authorities to more easily conduct data analysis and audits to ensure that taxpayers’ tax payments comply with legal requirements.

THE SOLUTIONS

From assessment to implementation

Readiness Assessment

We evaluate your current processes and systems to determine your readiness for e-invoicing and ensure a smooth transition.

Advisory & Process Review

Our experts guide you through e-invoicing regulations and help optimize your processes for compliance and efficiency.

Software & Technologies

We provide the e-invoicing software, technology solutions, and middleware integration tailored to your business needs.

Training & Workshops

We offer hands-on training and workshops to equip your team with the knowledge and skills needed to implement and manage e-invoicing effectively.

E-Invoice Implementation Workshop

Practical Guidance for Businesses to Kickstart E-Invoicing Compliance

What You’ll Learn:

E-Invoicing framework and government requirements

Implications for accounting processes and software integration

Practical implementation tips with real-life examples

Interactive discussions with professionals and peers

Why Join E-Invoice Implementation Workshop?

Led by experienced professionals, this 4-hour interactive session goes beyond theory to equip you with insights and implementation strategies. Whether you're a business owner, accountant, or system integrator, you'll gain the tools and knowledge needed to avoid common mistakes and implement e-Invoicing smoothly within your organization.

Avoid costly delays. Learn from experts. Get e-Invoicing right the first time.

E-Invoice Accounting Software Solutions

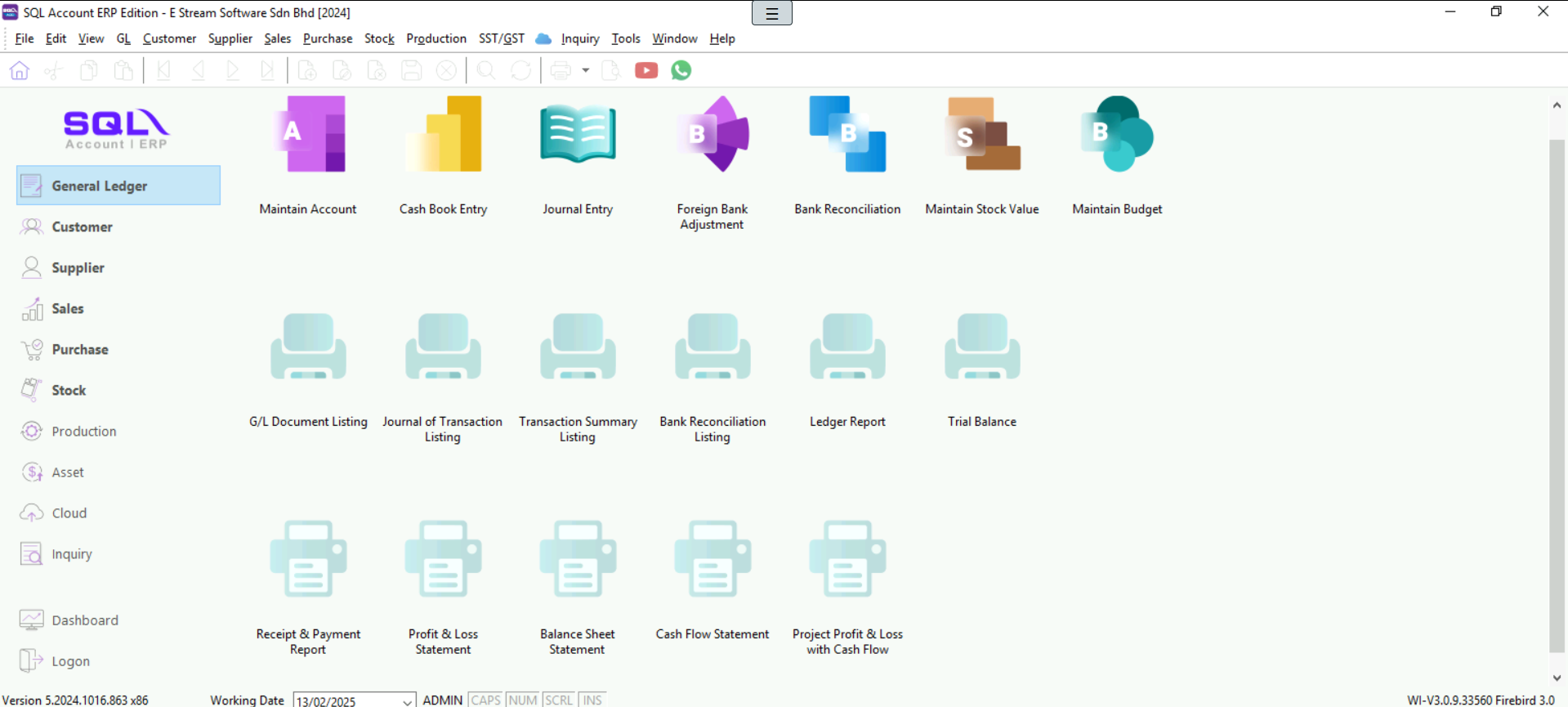

SQL Accounting Software

Suitable For: suitable for SMEs that require basic functions, e-commerce integration, or minimal stock management

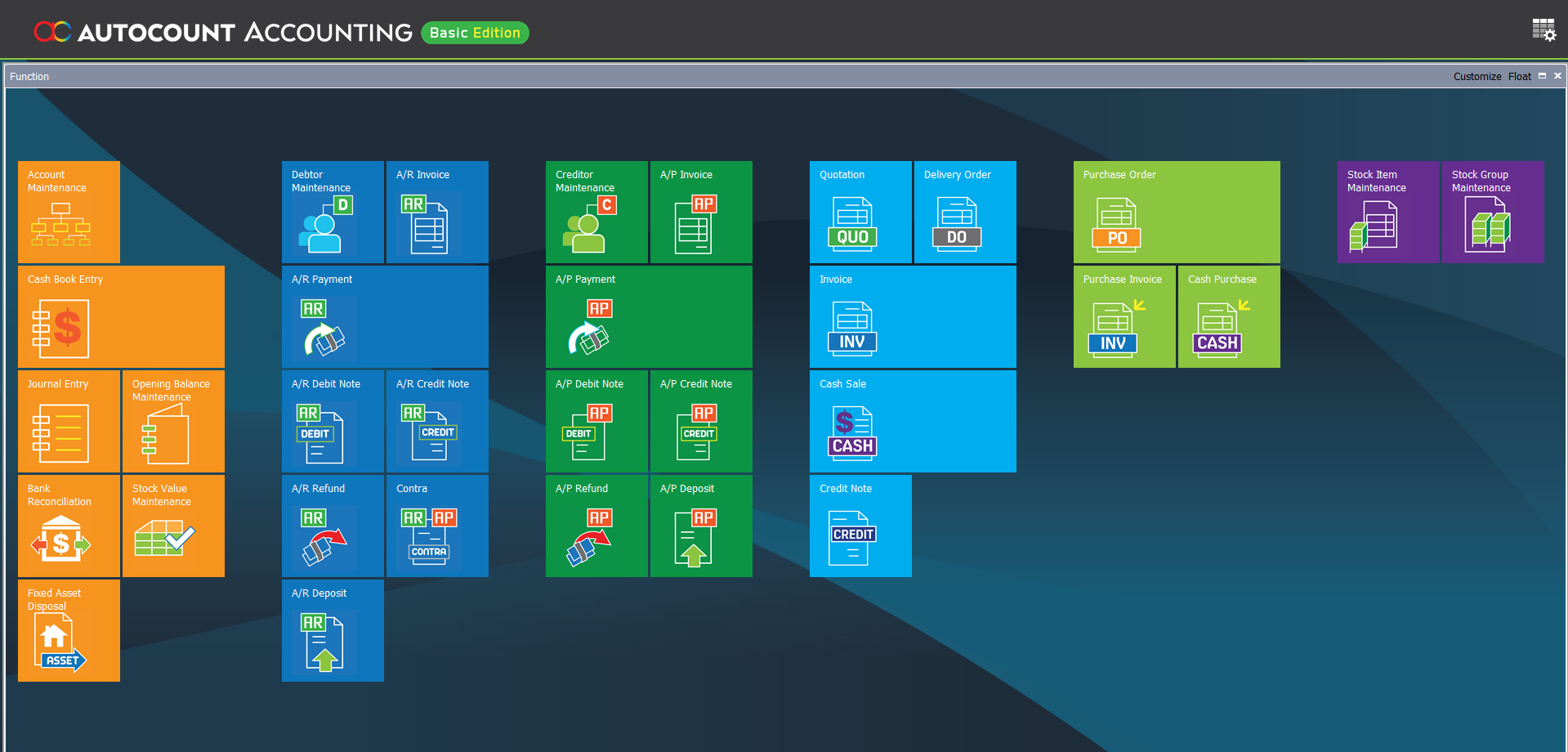

Autocount Accounting Software

Suitable For: Larger companies with complex stock management needs, offering advanced features and customization options.

Accounting Software

Your Ideal Business Software with SQL

SQL Account is an accounting software that is suitable for all businesses, from small businesses to large organizations. It is crucial to find a business solution that suits the nature of your business. The right accounting software will broaden the horizons and expand business opportunities for you.

Take your business to the next level with Autocount

A powerful and scalable tool for companies of all sizes. Its modular design lets you add features as you grow, from accounting and inventory to advanced payroll solutions. Handle multi-currency transactions, SST compliance, and customize every aspect to suit your needs.

FAQ e-invoice in Malaysia

What are the scenarios that require an e-invoice to be issued?

Proof of Income

Document is issued whenever a sale or other transaction is made to recognise income of taxpayers

Proof of Expense

Purchases made or other spending by taxpayers.

Includes returns, discounts, and income receipt correction.

Certain circumstances that requires taxpayers to self issue an e-Invoice to document an expense, such as foreign transactions

Exceptions

Employment income, Pension, Alimony, Distribution of dividend in specific circumstances, Zakat, Scholarship

What if Buyer doesn’t need E-Invoice?

The Supplier will issue a normal receipt/ bill/ invoice to the Buyer. Not required for IRBM’s validation as these documents are not e-Invoices.

IRBM allows the Suppliers to consolidate the transactions with Buyers (who do not require an e-Invoice as proof of expenses

What if Supplier didn’t prepare E-Invoice?

Certain circumstances where another party (other than the Supplier) will be allowed to issue a self-billed e-Invoice on behalf of Supplier.

Where a Buyer is required to issue a self-billed e-Invoice, the Buyer will assume the role of the Supplier to be the issuer of e-Invoice and submits it to IRBM for validation. Upon validation, Buyer would be able to use the validated e-Invoice as a proof of expense for tax purposes.

What are the consequences for failure to issue e-Invoice?

Failure to issue e-Invoice is an offence under Section 120(1)(d) of the Income Tax Act 1967

not exceeding 6 months or both, for each non-compliance.

Are Malaysian buyers required to include the import duty and/or sales tax levied by the RMCD upon customs clearance on imported goods when issuing self-billed e-Invoice?

No, Malaysian buyers are not required to include the duties and/or taxes levied by the RMCD in

the self-billed e-Invoice.

Are taxpayers allowed to continue claiming for tax deduction / personal tax relief without an e-Invoice?

Yes, taxpayers can continue to claim tax deductions or personal tax relief using existing

documentation until such time the legislation has been amended.

CONTACT US

Get in touch with us

A Quick Comparison

Digital Invoice vs E-Invoice

Digital Invoice

A digital invoice is any invoice in electronic format, such as PDFs, Excel files, or scanned copies. It is manually sent via email or other channels and does not require real-time validation. While convenient, it often requires manual processing, making it prone to errors and compliance issues.

E-Invoice

An e-invoice follows a structured format (XML/JSON) and is electronically transmitted through a government-approved system. It requires validation by tax authorities, ensuring compliance with legal standards. E-invoices integrate with accounting systems, enabling automation, security, and accuracy, making them mandatory in many countries for tax reporting.

Implementation Period

When it starts?

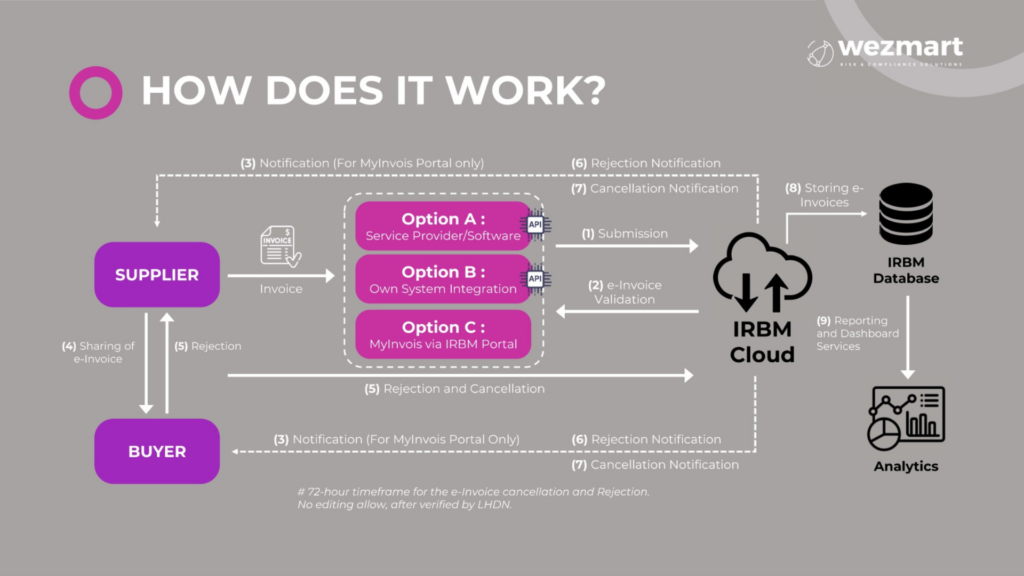

Workflow Overview

How does it work?

Model Overview

Overview of e-Invoice Model

Myinvois Portal

- A portal hosted by IRBM

- Accessible to all taxpayers at no cost

- Also accessible to taxpayers who need to issue e-Invoice where Application Programming Interface (API) connection is unavailable

Application Programming Interface (API)

- An API is a set of programming code that enables direct data transmission between the taxpayers’ system and MyInvois system

- Requires upfront investment in technology and adjustments to taxpayers’ existing systems

- Ideal for large taxpayers or businesses with substantial transaction volumes

- The figure below demonstrates an overview of the e-Invoice workflow from the point a sale is made or transaction is undertaken, and an e-Invoice is issued by the supplier via MyInvois Portal or API, up to the point of storing validated e-Invoices on IRBM’s database for taxpayers to view their respective historical e-Invoices.

- Automates the e-Invoice submission process, reducing manual work.

- Suitable for businesses of all sizes, from SMEs to large corporations.

- Stores validated e-Invoices for future reference and audit purposes.