For foreign entrepreneurs:

set up a company in Malaysia

- Trusted by 4000+ Clients in Southeast Asia

- Digital Registration Experience

- 91% of customers recommend us

More Than 20 years of experience

iComSec is the digital corporate secretarial firm that simplifies the processes of incorporating, running and governing a company through an online platform.

WHY iComSec

Simple online company setup for foreigners

with full support

One stop for all requirements

Go digital and paperless on your end

Online registration anytime, anywhere

Assist you with bank account opening

WHO WE HELP

For founders starting

or expanding their business

Solopreneur

We help solo consultants, traders, IT experts, and other professionals easily set up their businesses and enjoy local tax benefits.

Entrepreneurs expanding

Expanding your business to new markets? We help you with local compliance, accounting, and financial reporting setup.

Operating from Malaysia

We help you obtain the right visa to start your foreign business in Malaysia, whether you're here on an Employment or Dependant's Pass, or relocating from abroad

Get Started

Here’s what you need to incorporate a company

Your eligibility as a director

- At least 1 director resides in Malaysia

- Residential address

- Age of 18 and above

- Not bankrupt

Documents needed

- Photocopy of IC

- Consent letter (if your proposed company name is similar to related or associated corporation/ is a trademark / has controlled words)

Download your FREE Doing Business in Malaysia

We’ve put together all of the documents and details you need to figure out before you open a company.

PRICING

Incorporation plans to fit your business

in Malaysia

Incorporation + Secretary

Perfect if you want us to register your business and take care of annual filings with

Consultation + Incorporation + Secretary

1-on-1 consultation service for establishing a company in Malaysia (60 minutes).

RM1,050 government fees: name application and registration fee.

Preparing all registration forms.

Filing with Suruhanjaya Syarikat Malaysia ("SSM").

Minutes of first board meeting.

Resolution for opening first bank account.

Preparing 2 sets of certified copies of superform (Sec 14), notification of registration (Sec 15), certificate of incorporation (Sec 17) and notification of first company secretary (Sec 58).

Selected number of resolutions. For example: fix financial record address, appointment 1st auditors' and tax agent, fixing financial year end.

Common seal, share certificates and consultation on pre-incorporation matters.

Full Compliance

If you want your first year covered, from company formation to expert support and filing

Consultation + Incorporation + Secretary

1-on-1 consultation service for establishing a company in Malaysia (60 minutes).

RM1,050 government fees: name application and registration fee.

Preparing all registration forms.

Filing with Suruhanjaya Syarikat Malaysia ("SSM").

Minutes of first board meeting.

Resolution for opening first bank account.

Preparing 2 sets of certified copies of superform (Sec 14), notification of registration (Sec 15), certificate of incorporation (Sec 17) and notification of first company secretary (Sec 58).

Selected number of resolutions. For example: fix financial record address, appointment of 1st auditors and tax agent, fixing financial year end.

Common seal, share certificates, and consultation on pre-incorporation matters.

Accounting and Tax

Compilation of management accounts.

Yearly Bookkeeping by accountant (< 65 transaction per month / <85 receipts per month)

FREE Autocount Cloud Accounting Software*

Add-ons you might need

Nominee Director - RM6,000 for 6 months

As a foreigner not residing in Malaysia, you cannot establish or manage a business in the country. While you search for the right local partner, we can assist in appointing a qualified nominee local director for your Malaysian company.

Employment Pass (EP) - RM7,000

Upon fulfill of requirement, we will file your CV with relevant professional experience, education data and the company profile to get the visa.

*All the prices above are exclusive of 8% SST

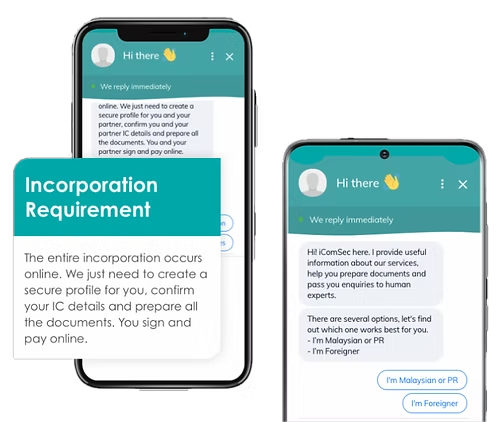

Got questions?

Chat with our local experts

Choose a convenient time to chat with our experts and get the answers you need to take the next step.

Incorporation Process

4 steps for setting up a foreign

company in Malaysia

1. Meet the Official Requirements

We help you with everything Singapore’s Accounting and Corporate Regulatory Authority (ACRA) needs from business founders:

Malaysia law requires each company to have a secretary. This officer is in charge of state compliance. They file annual returns and resolutions on changes, prepare Annual General meetings, and processes dividends distribution.

At least one of your directors has to be a Singapore resident. Hiring a nominee is a common and legal practice.

A nominee puts their name on your papers but can’t make any core business decisions. If there’s any wrongdoing, such as late or incorrect reports, the nominee director shares legal responsibility. That’s why you have to get an accounting package with this service.

Registered address

All Singaporean companies must have a local registered address. It goes on all legal documents. We receive your correspondence, scan and forward them to you.

2. Get Your Company Set Up and Registered

We partner with Singapore banks and payment services that can open a business bank account for you remotely online. We present you to the banks, but we can’t guarantee you’ll get an account for your business. The decision is always up to banks.

Each bank has their own procedure to open an account without physically visiting the branch. They do KYC interviews online using video conferencing and send couriers to exchange docs. Talk to us to learn about details, rates, and requirements.

3. Open a Business Account

We partner with Singapore banks and payment services that can open a business bank account for you remotely online. We present you to the banks, but we can’t guarantee you’ll get an account for your business. The decision is always up to banks.

Each bank has their own procedure to open an account without physically visiting the branch. They do KYC interviews online using video conferencing and send couriers to exchange docs. Talk to us to learn about details, rates, and requirements.

4. Set up your accounting calendar

You need to submit several tax reports a year. Your accounting team will organise your docs, prepare reports, and file them neatly. We also advise on exemption options for you as a foreign business owner in Singapore.

Even if you have no transactions, you still need to submit annual reports: Estimated Chargeable Income, financial statements, and annual tax return called Form C or Form C-S. It’s crucial to prepare them right and on time, otherwise your company and the Nominee director can face fines and penalties.

CONTACT US

Get in touch with us

Facts & numbers

91%

of customers

recommend iComSec

services