Upcoming Events:

RM54 nett

per participant

本次分享会的注册仅限在线注册。

* 包含了8%SST

2025年4月17日 (9:30am – 12pm)

Wezmart International Berhad – bpoSA360 Digital Workspace

25, Jln Puteri 7/15, Bandar Puteri, 47100 Puchong, Selangor, Malaysia

电子发票计划与税务影响 – 企业经营的新挑战与机遇(英文讲解)

2025年4月24日 (9:30am – 12pm)

Wezmart International Berhad – bpoSA360 Digital Workspace

25, Jln Puteri 7/15, Bandar Puteri, 47100 Puchong, Selangor, Malaysia

电子发票计划与税务影响 – 企业经营的新挑战与机遇(中文讲解)

什么是电子发票?

电子发票是指在购买和销售商品、提供或接受服务以及其他商业活动中,以电子方式开具、接收和存储的付款凭证。在不久的将来,政府将全面实施电子发票系统,取代纸质或电子文档形式的发票、退货凭证和附加费用凭证等。

电子发票的实施也将对税务管理产生深远的影响。通过电子发票系统,政府可以更高效地监督交易流程,减少逃税和避税的可能性。电子发票记录的数字化特性也使税务部门能够更轻松地进行数据分析和审计,确保纳税人的税款缴纳符合法律要求。

会计软件

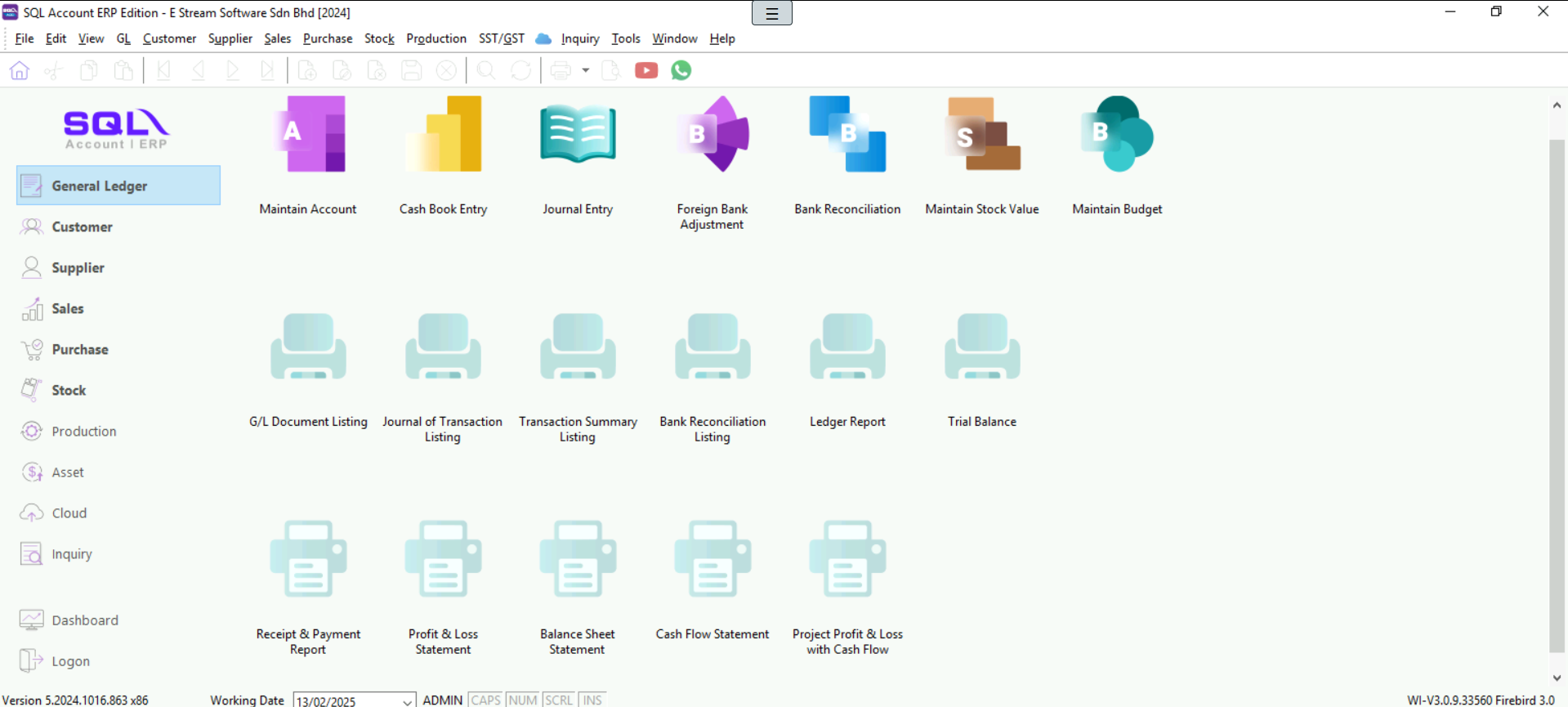

SQL 会计软件

适用于:适合需要基本功能、电子商务集成或简单库存管理的中小企业

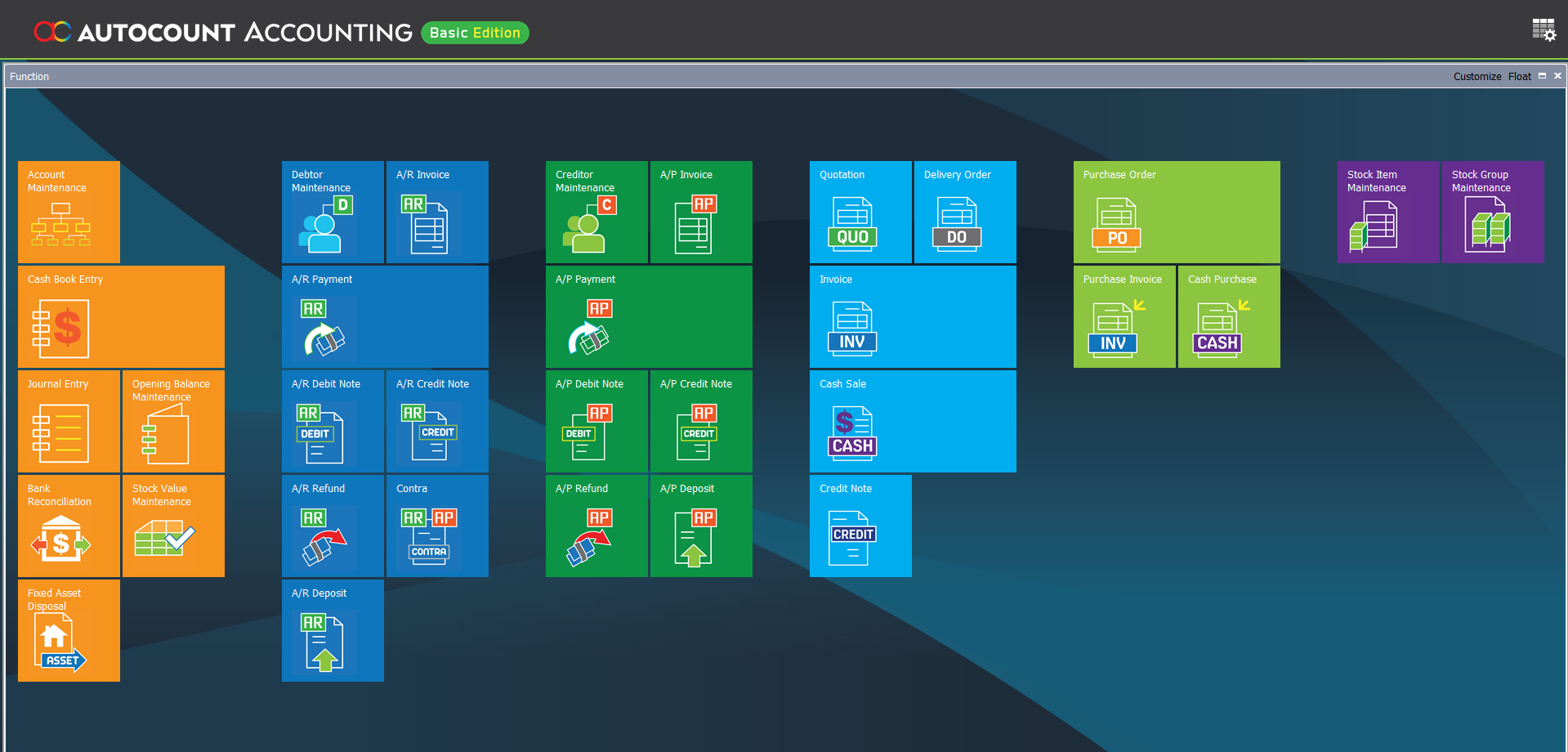

Autocount 会计软件

适用于:适合需要复杂库存管理的大型企业,提供高级功能和定制化选项,以满足其多样化的业务需求。

Accounting Software

Your Ideal Business Software with SQL

SQL Account is an accounting software that is suitable for all businesses, from small businesses to large organizations. It is crucial to find a business solution that suits the nature of your business. The right accounting software will broaden the horizons and expand business opportunities for you.

Take your business to the next level with Autocount

A powerful and scalable tool for companies of all sizes. Its modular design lets you add features as you grow, from accounting and inventory to advanced payroll solutions. Handle multi-currency transactions, SST compliance, and customize every aspect to suit your needs.

电子发票的FAQ

什么情况下需要索取电子发票?

收入证明(Proof of Income)

- 在发生销售或其他交易时签发的文件,用于确认纳税人的收入。

费用证明(Proof of Expense)

- 纳税人进行的购买或其他支出。

- 包括退货、折扣和收入收据更正。

- 在某些情况下,纳税人需要自开电子发票以记录费用,例如跨境交易。

例外情况(Exceptions)

以下情况通常不需要签发电子发票:

- 就业收入(如工资、薪金)

- 养老金

- 赡养费(Alimony)。

- 特定情况下的股息分配

- 天课(Zakat)

- 奖学金

如果买家不需要电子发票?

供应商将向买家开具普通的收据/账单/发票。这些文件不需要经过马来西亚内陆税收局(IRBM)的验证,因为它们不是电子发票。

IRBM允许供应商将与买家之间的交易进行合并(针对那些不需要电子发票作为费用证明的买家)。

如果供应商没有提供电子发票?

在某些特定情况下,允许另一方(非供应商)代表供应商签发自开电子发票(self-billed e-Invoice)。

当买家被要求签发自开电子发票时,买家将承担供应商的角色,作为电子发票的开具方,并将其提交给马来西亚内陆税收局(IRBM)进行验证。验证通过后,买家可以将经过验证的电子发票用作税务用途的费用证明。

没有提供电子发票会有什么后果?

根据《1967年所得税法》第120(1)(d)条,未开电子发票属于违法行为,每次违规将面临不低于200令吉且不超过20,000令吉的罚款,或不超过6个月的监禁,或两者兼施。

马来西亚买家在签发自开电子发票时,是否需要包含由马来西亚皇家海关局(RMCD)对进口商品征收的进口关税和/或销售税?

不需要,马来西亚买家在开自开电子发票(self-billed e-Invoice)时,无需包含由马来西亚皇家海关局(RMCD)征收的关税和/或税款。

纳税人是否可以在没有电子发票的情况下继续申请税务扣除或个人税务减免?

是的,在相关法规修订之前,纳税人可以继续使用现有文件申请税务扣除或个人税务减免

Streamline Your E-Invoice With Us

E-Invoicing Readiness Assessment + Advisory

Our E-Invoicing Readiness Assessment & Advisory service ensures a seamless shift by evaluating your current processes, people, and technology to determine e-Invoice compatibility. We begin with a comprehensive checklist to assess your readiness, followed by a personalized briefing covering key aspects such as e-Invoicing fundamentals, tax implications, and a dedicated Q&A session to address your concerns. Let us simplify your transition with expert guidance—ensuring compliance while optimizing your workflow. Get in touch today to future-proof your business!

Accounting Software

To further simplify e-Invoicing submission, we provide AutoCount Accounting Software and SQL Accounting Software, both fully integrated with LHDN’s e-Invoicing system to ensure seamless compliance. These powerful solutions automate invoicing, eliminate manual errors, and streamline financial management—giving you peace of mind that your e-Invoices are submitted without issues. Let us help you transition smoothly with expert guidance and the right technology. Get in touch today to future-proof your business!

CONTACT US

Get in touch with us

A Quick Comparison

Digital Invoice vs E-Invoice

Digital Invoice

A digital invoice is any invoice in electronic format, such as PDFs, Excel files, or scanned copies. It is manually sent via email or other channels and does not require real-time validation. While convenient, it often requires manual processing, making it prone to errors and compliance issues.

E-Invoice

An e-invoice follows a structured format (XML/JSON) and is electronically transmitted through a government-approved system. It requires validation by tax authorities, ensuring compliance with legal standards. E-invoices integrate with accounting systems, enabling automation, security, and accuracy, making them mandatory in many countries for tax reporting.

Implementation Period

When it starts?

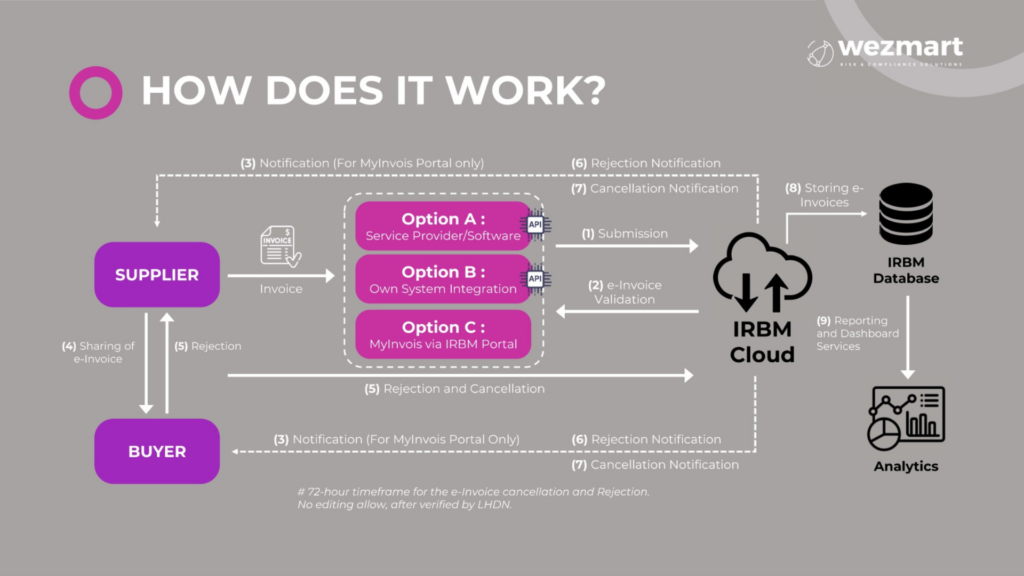

Workflow Overview

How does it work?

Model Overview

Overview of e-Invoice Model

Myinvois Portal

- A portal hosted by IRBM

- Accessible to all taxpayers at no cost

- Also accessible to taxpayers who need to issue e-Invoice where Application Programming Interface (API) connection is unavailable

Application Programming Interface (API)

- An API is a set of programming code that enables direct data transmission between the taxpayers’ system and MyInvois system

- Requires upfront investment in technology and adjustments to taxpayers’ existing systems

- Ideal for large taxpayers or businesses with substantial transaction volumes

- The figure below demonstrates an overview of the e-Invoice workflow from the point a sale is made or transaction is undertaken, and an e-Invoice is issued by the supplier via MyInvois Portal or API, up to the point of storing validated e-Invoices on IRBM’s database for taxpayers to view their respective historical e-Invoices.

- Automates the e-Invoice submission process, reducing manual work.

- Suitable for businesses of all sizes, from SMEs to large corporations.

- Stores validated e-Invoices for future reference and audit purposes.