Company incorporation services in Malaysia

- Trusted by 4000+ Clients in Southeast Asia

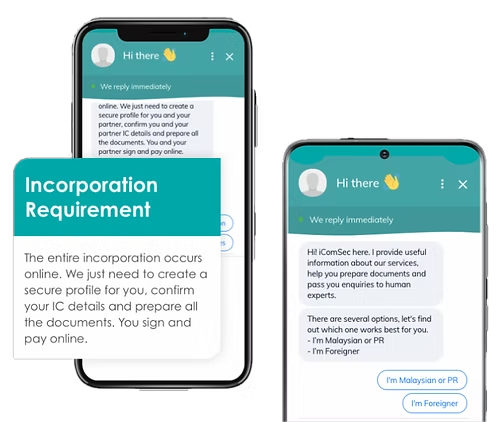

- Digital Registration Experience

- 91% of customers recommend us

More Than 20 years of experience

iComSec is the digital corporate secretarial firm that simplifies the processes of incorporating, running and governing a company through an online platform.

WHERE ARE YOU FROM?

Company incorporation in Malaysia:

are you local?

WHY iComSec

Why choose iComSec for your

company incorporation?

Accountants who understand your business needs

Easy-to-use software built for business owners

Business Consulting

Dedicated in-house team of experts

Got questions?

Chat with our local experts

Choose a convenient time to chat with our experts and get the answers you need to take the next step.

PRICING

Incorporation plans to fit your business

in Malaysia

Incorporation

Perfect if you want us to register your business locally

Private Company (SDN BHD)

Inclusive of. RM1,050 government fees: name application and registration fee.

Checking the proposed company name for availability

Company name reservation and application

Preparing resolution to open bank account.

Preparing all registration forms.

Preparing 2 sets of certified copies of superform (Sec 14), notification of registration (Sec 15), certificate of incorporation (Sec 17) and notification of first company secretary (Sec 58).

Selected number of resolutions. For example: fix financial record address, appointment 1st auditors' and tax agent, fixing financial year end.

Filing all registration forms with SSM

. Certificate of incorporation

Incorporation + Secretary

If you want your first year covered, from company formation to expert support and filing

Incorporation + Secretary

RM1,050 government fees: name application and registration fee.

Preparing all registration forms.

Filing with Suruhanjaya Syarikat Malaysia ("SSM").

Minutes of first board meeting.

Resolution for opening first bank account.

Preparing 2 sets of certified copies of superform (Sec 14), notification of registration (Sec 15), certificate of incorporation (Sec 17) and notification of first company secretary (Sec 58).

Selected number of resolutions. For example: fix financial record address, appointment of 1st auditors and tax agent, fixing financial year end.

Share certificates and consultation on pre-incorporation matters.

6-months retainer fees.

Incorporation + Secretary

Perfect if you want us to register your business and take care of annual filings

Incorporation + Secretary

RM1,050 government fees: name application and registration fee.

Preparing all registration forms.

Filing with Suruhanjaya Syarikat Malaysia ("SSM").

Minutes of first board meeting.

Resolution for opening first bank account.

Preparing 2 sets of certified copies of superform (Sec 14), notification of registration (Sec 15), certificate of incorporation (Sec 17) and notification of first company secretary (Sec 58).

Selected number of resolutions. For example: fix financial record address, appointment 1st auditors' and tax agent, fixing financial year end.

Common seal, share certificates and consultation on pre-incorporation matters.

Full Compliance

If you want your first year covered, from company formation to expert support and filing

Incorporation + Secretary

RM1,050 government fees: name application and registration fee.

Preparing all registration forms.

Filing with Suruhanjaya Syarikat Malaysia ("SSM").

Minutes of first board meeting.

Resolution for opening first bank account.

Preparing 2 sets of certified copies of superform (Sec 14), notification of registration (Sec 15), certificate of incorporation (Sec 17) and notification of first company secretary (Sec 58).

Selected number of resolutions. For example: fix financial record address, appointment of 1st auditors and tax agent, fixing financial year end.

Common seal, share certificates, and consultation on pre-incorporation matters.

Accounting

Compilation of management accounts.

Yearly Bookkeeping by accountant (< 65 transaction per month / <85 receipts per month)

FREE Cloud Accounting Software*

*All the prices above are exclusive of 8% SST

Get Started

Here’s what you need to incorporate a company

Your eligibility as a director

- At least 1 director resides in Malaysia

- Residential address

- Age of 18 and above

- Not bankrupt

Documents needed

- Photocopy of IC

- Consent letter (if your proposed company name is similar to related or associated corporation/ is a trademark / has controlled words)

TYPES OF INCORPORATION

Select the type of company you wish to incorporate

Private Limited Company (Sdn. Bhd.)

A Private Limited Company (Sdn. Bhd.) in Malaysia is the most popular business structure for entrepreneurs and SMEs. It offers limited liability protection, meaning the owners’ personal assets are protected from business debts. This structure is ideal for businesses looking to grow and attract investors while maintaining control and minimizing risks.

One of the key advantages of an Sdn. Bhd. is its tax benefits. In Malaysia, Private Limited Companies are subject to corporate tax rates that are generally lower than individual tax rates. The table below outlines the corporate tax rates for Malaysian Sdn. Bhd. companies:

| Chargeable Income | Tax Rate |

|---|---|

| Up to RM600,000 | 17% |

| Above RM600,000 | 24% |

The first RM600,000 of chargeable income is taxed at a reduced rate of 17%, while income above this threshold is taxed at 24%. This creates a significant advantage for small and medium-sized enterprises (SMEs), allowing them to reinvest more in their business during the initial growth phase.

Additionally, Sdn. Bhd. companies can also enjoy flexibility in dividend distribution. Shareholders can receive dividends without being taxed twice, as dividends are paid out of profits that have already been taxed at the corporate level.

An Sdn. Bhd. also provides credibility, operational flexibility, and a clear distinction between personal and business assets. This structure can have up to 50 shareholders, and it is suitable for local and foreign entrepreneurs seeking to expand in the Malaysian market. Incorporating as an Sdn. Bhd. is essential for businesses looking to build a reputable and legally protected entity in Malaysia while optimizing their tax liabilities.

Whether you’re starting a small business or planning for long-term growth, incorporating as an Sdn. Bhd. ensures compliance with Malaysian company laws, provides a solid foundation for your business, and offers valuable tax advantages.

Sole Proprietorship

A Sole Proprietorship is the simplest and most straightforward type of business structure in Malaysia. It is owned and operated by a single individual, offering complete control over the business’s operations and decision-making. This structure is ideal for small businesses, freelancers, or solo entrepreneurs looking to start a business with minimal formalities and lower operational costs.

Key Features of a Sole Proprietorship:

- Ownership: The business is owned by one person who has full control over all aspects of the company.

- Liability: The owner is personally liable for any debts and obligations of the business. This means personal assets are at risk in case of financial issues.

- Registration: To set up a Sole Proprietorship, you must register with the Companies Commission of Malaysia (SSM). The process is quick and easy, with minimal paperwork.

- Taxation: Income from a Sole Proprietorship is taxed at the individual’s personal tax rate, which can be higher compared to corporate tax rates. The taxable income is treated as part of the individual’s total income for the year.

Sole Proprietorship Tax Rates in Malaysia:

The income from a Sole Proprietorship is subject to individual income tax rates. Below is a table showing the Malaysian personal income tax rates:

| Chargeable Income (RM) | Tax Rate |

|---|---|

| Up to RM5,000 | 0% |

| RM5,001 – RM20,000 | 1% |

| RM20,001 – RM35,000 | 3% |

| RM35,001 – RM50,000 | 8% |

| RM50,001 – RM70,000 | 14% |

| RM70,001 – RM100,000 | 21% |

| RM100,001 – RM250,000 | 24% |

| RM250,001 – RM400,000 | 24.5% |

| Above RM400,000 | 25% |

A Sole Proprietorship is ideal for entrepreneurs who want complete control over their business, have a low-risk business model, or are just starting with minimal capital. However, it’s important to note that personal liability could be a disadvantage, as the business owner is personally responsible for any debts or legal issues.

In terms of tax benefits, Sole Proprietors have fewer opportunities for tax planning compared to other business structures like Sdn. Bhd. or LLP. However, they benefit from simpler registration, lower compliance costs, and direct ownership.

Why Choose a Sole Proprietorship?

- Ease of Setup: The registration process is simple and inexpensive.

- Full Control: The owner has complete decision-making power.

- Lower Startup Costs: Operating a Sole Proprietorship generally requires less capital to start.

- Tax Simplicity: The income is taxed as personal income, which may be beneficial for small businesses.

However, it’s important to carefully consider the personal liability aspect before choosing this structure. A Sole Proprietorship may be best suited for low-risk businesses, but for companies that plan to scale or wish to limit liability, other structures like Sdn. Bhd. might be more appropriate.

Enterprise / Partnership

An Enterprise (also known as Partnership) is another popular business structure in Malaysia, ideal for small to medium-sized businesses. Unlike a Sole Proprietorship, an Enterprise allows for multiple owners or partners to jointly run the business. This structure is perfect for entrepreneurs who want to share responsibilities, risks, and profits while enjoying a straightforward setup.

Key Features of an Enterprise / Partnership:

- Ownership: A partnership consists of two or more individuals (up to 20 partners) who share ownership, decision-making, and profits of the business. In an Enterprise, the partners must have a shared vision and agreement on how the business operates.

- Liability: Like a Sole Proprietorship, an Enterprise also carries unlimited liability, meaning partners are personally liable for business debts. Personal assets are at risk if the business faces financial difficulties.

- Registration: Enterprises must be registered with the Companies Commission of Malaysia (SSM). The registration process is simple, and the business can start operations soon after.

- Taxation: Enterprises are subject to individual tax rates based on the profits earned by the business. Each partner is taxed individually based on their share of the business income.

Enterprise / Partnership Tax Rates in Malaysia:

The income of an Enterprise or Partnership is taxed under the individual income tax rates. Below is a table showing the applicable tax rates:

| Chargeable Income (RM) | Tax Rate |

|---|---|

| Up to RM5,000 | 0% |

| RM5,001 – RM20,000 | 1% |

| RM20,001 – RM35,000 | 3% |

| RM35,001 – RM50,000 | 8% |

| RM50,001 – RM70,000 | 14% |

| RM70,001 – RM100,000 | 21% |

| RM100,001 – RM250,000 | 24% |

| RM250,001 – RM400,000 | 24.5% |

| Above RM400,000 | 25% |

Each partner in the business is taxed based on their share of the profit. For example, if a partnership has two partners with equal shares in the profits, each partner will be taxed individually on half of the total income.

Benefits of Enterprise / Partnership:

- Ease of Setup: Similar to a Sole Proprietorship, registering an Enterprise is simple and cost-effective.

- Shared Responsibilities: Partners can share the workload and responsibilities, bringing together different skills and expertise.

- Lower Startup Costs: Like the Sole Proprietorship, the Enterprise has relatively low startup costs.

- Flexibility: Partners can agree on various aspects of the business, including profit-sharing, management, and decision-making processes.

- Tax Simplicity: Profits are passed through to the individual partners, which simplifies tax reporting.

Drawbacks of Enterprise / Partnership:

- Unlimited Liability: Both partners are personally liable for the business’s debts, meaning personal assets are at risk.

- Potential Disputes: Business partners must work closely together, and disagreements could arise if roles and responsibilities are not clearly defined.

- Limited Capital: While partners can pool resources, the business might still face restrictions in raising capital compared to a Sdn. Bhd..

An Enterprise or Partnership structure is suitable for entrepreneurs who want to collaborate with others in a business venture. It offers a flexible way to operate a business, share resources, and reduce individual burdens. However, the unlimited liability and potential for disputes make it important to carefully choose business partners and define roles clearly in a partnership agreement.

Limited Liability Partnership (LLP)

A Limited Liability Partnership (LLP) is a hybrid business structure in Malaysia that combines the flexibility of a partnership with the limited liability protection of a private limited company (Sdn. Bhd.). This structure is ideal for professionals, consultants, or small to medium-sized businesses that want to limit personal liability while benefiting from the operational flexibility of a partnership.

Key Features of a Limited Liability Partnership (LLP):

- Ownership: An LLP requires at least two partners (who can be individuals or corporate entities). There is no upper limit on the number of partners, providing flexibility for business growth.

- Liability: Unlike a Sole Proprietorship or Partnership, the LLP offers limited liability protection. Partners are only liable for the debts of the LLP up to the amount of their capital contribution, unlike traditional partnerships where personal assets are at risk.

- Registration: LLPs must be registered with the Companies Commission of Malaysia (SSM). The registration process is more formal than a Sole Proprietorship or Partnership, and there are annual compliance requirements.

- Taxation: An LLP is treated as a pass-through entity for tax purposes, meaning that the profits and losses are passed directly to the partners, who are then taxed individually based on their share of the income. The LLP itself is not subject to tax, but it must file an annual income tax return.

LLP Tax Rates in Malaysia:

Since an LLP is a pass-through entity, each partner is taxed individually on their share of the income. The applicable individual income tax rates are as follows:

| Chargeable Income (RM) | Tax Rate |

|---|---|

| Up to RM5,000 | 0% |

| RM5,001 – RM20,000 | 1% |

| RM20,001 – RM35,000 | 3% |

| RM35,001 – RM50,000 | 8% |

| RM50,001 – RM70,000 | 14% |

| RM70,001 – RM100,000 | 21% |

| RM100,001 – RM250,000 | 24% |

| RM250,001 – RM400,000 | 24.5% |

| Above RM400,000 | 25% |

Partners are taxed individually on their share of the LLP’s profits, according to the personal income tax rates mentioned above.

Benefits of Limited Liability Partnership (LLP):

- Limited Liability: The biggest advantage of an LLP is the limited liability protection it offers to partners, protecting personal assets in case of business debts.

- Operational Flexibility: LLPs provide the operational flexibility of a partnership, where partners can manage the business and share profits without the complexity of a private limited company.

- Separate Legal Entity: An LLP is a separate legal entity from its partners, which means it can own property, enter into contracts, and sue or be sued in its name.

- Credibility: Operating as an LLP can enhance business credibility and attract clients or investors who may be more comfortable with a business that has limited liability protection.

- Tax Efficiency: The LLP structure avoids the double taxation that is common in some other business structures, as the income is only taxed at the individual partner level.

Drawbacks of Limited Liability Partnership (LLP):

- Registration & Compliance: LLPs require more formal registration and regulatory compliance compared to sole proprietorships and partnerships, including filing annual returns.

- No Public Funding: Unlike Sdn. Bhd. companies, an LLP cannot issue shares to the public or raise capital from shareholders, which may limit its funding options.

- Limited Scope: While flexible, the LLP structure is generally suited for small to medium-sized enterprises or professional services, and may not be the best fit for large corporations with multiple stakeholders.

Why Choose an LLP?

- Limited Liability: Protects your personal assets from business debts.

- Flexible Operations: You can structure the business to suit the needs of its partners, with fewer formalities than a Sdn. Bhd..

- Professional Services: Ideal for consultants, accountants, lawyers, and other professionals who wish to combine the flexibility of a partnership with the liability protection of a company.

- Tax Efficiency: Avoids double taxation by allowing partners to report profits on their individual returns.

An LLP is a great option for businesses that want the best of both worlds: the flexibility of a partnership and the limited liability protection of a company. It’s perfect for professional service firms and small businesses looking to limit personal liability while maintaining operational freedom.

INCORPORATION PROCESS

How iComSec

helps incorporate a company in Malaysia

in easy steps

Choose Your Business Structure

Whether you’re looking to incorporate a Private Limited Company (Sdn. Bhd.), a Sole Proprietorship, or a Partnership, we provide expert advice to help you make an informed decision that suits your business goals. At iComSec, we assist you in understanding the benefits and requirements of each structure, helping you choose the most appropriate one.

We incorporate your company

We handle the process 100% online. This includes collecting your documents via chat, process KYC for all directors and shareholders, and fill in all the necessary documents. We submit the application to the SSM, and upload all data into your iComSec account.

We incorporate

your company

We handle the process 100% online. This includes collecting your documents via chat, process KYC for all directors and shareholders, and fill in all the necessary documents. We submit the application to the SSM, and upload all data into your iComSec account.

Download your FREE Pre-Incorporation checklist

We’ve put together all of the documents and details you need to figure out before you open a company.

CONTACT US

Get in touch with us

TESTIMONIALS

What our clients say about iComSec services

Facts & numbers

91%

of customers

recommend iComSec

services

EXCELLENTTrustindex verifies that the original source of the review is Google. Elvina and the Cosec team offered prompt and professional assistance, helping my referral set up a company within days 👍🏻Posted onTrustindex verifies that the original source of the review is Google. They are providing professional service and I would recommended to my friends and customersPosted onTrustindex verifies that the original source of the review is Google. Great experience with iComSec! The team is professional, responsive, and knowledgeable. They made the whole process smooth and efficient. Highly recommended for anyone looking for reliable corporate services.Posted onTrustindex verifies that the original source of the review is Google. Very responsive and provide good advice .Posted onTrustindex verifies that the original source of the review is Google. Had a very pleasant experience with Vivien who helped us set up our company very quickly and is always a message away whenever we need help with administrative matters. Highly recommend VivienPosted onTrustindex verifies that the original source of the review is Google. I want to express my gratitude to Vivian at iComSec for her exceptional assistance during the company incorporation process. Her guidance was invaluable, ensuring a smooth and efficient experience that exceeded my expectations. Vivian's professionalism, attention to detail, and prompt responses truly set her apart. I highly recommend iComSec and Vivian for their outstanding service in company incorporation. Thank you, Vivian!Posted onTrustindex verifies that the original source of the review is Google. Good goodPosted onTrustindex verifies that the original source of the review is Google. Very good service and good advice by miss VivienVerified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

FAQ

Ready to Incorporate Your Company in Malaysia?

What do I need to do before I start my company formation in Malaysia?

OK, here is a little guide on how to prepare for using a company formation service in Malaysia. There are things to decide before submitting the papers, let us go through them:

You need to choose a company name, which we will send to Suruhanjaya Syarikat Malaysia (“SSM”) for approval.

You need a paid-up capital, RM1 is enough.

Setting up a company in Malaysia requires a local address: a real place in the city-state to receive official letters. If you don’t have one, you can use ours: we notify you about your correspondence, scan, and send it to you.

You must engage a Company Secretary, a person certified under various regulations responsible for lodging and filing in time all necessary documents required by law.

You provide the list of directors, their IDs and contact data. A foreigner can’t run a business in Malaysia if his company has no resident director. Hiring a local nominee solves the problem. Having him, you can become a director yourself or appoint another executive from abroad.

You decide on the share structure and send us the list of the shareholders. There can be 1–50, both individuals or companies.

And what if I am a foreigner?

You can’t file the paperwork yourself and must employ a certified agency to register your business. We’ll process your application to Suruhanjaya Syarikat Malaysia (“SSM”).

You only need to fly to Malaysia to open a bank account, the rest is managed online.

If you want to move to Malaysia, we can help you to arrange Employment Pass, a working visa.

What documents do I need to prepare?

We’ll ask you for this information:

Company name

Directors’ particulars

Shareholders’ particulars

We’ll provide the following:

Company Secretary particulars

Nominee director particulars (if required)

Local address (if required)

What are the requirements?

How long does the company registration take?

Do I need a company address?

What's Company Secretary?

How does the process looks like?

We check that the company name you’ve chosen is available. You send us your IC or passport copy, details of directors and shareholders. We prepare all the necessary documents, send them to you for electronic signature, and submit them to Susuhanjaya Syarikat Malaysia (“SSM”). On your end, it’s just a message thread in a secure chat. Once Certificate of Incorporation has been issued, your company is operational.

Who can be a director?

Anybody above 18 years old, Malaysia locals or foreigners. You can have as many directors as you want, or it could be just you. (“SSM”). On your end, it’s just a message thread in a secure chat. Once Certificate of Incorporation has been issued, your company is operational.

Ready to Incorporate Your Company in Malaysia?

Start Your Company in Malaysia

Starting your business in Malaysia is easy with our end-to-end incorporation services. Our team ensures compliance with SSM regulations while guiding you through the registration process.

Or you want to chat with our expert?

Communicate with one of our incorporation specialist and get the answers straight away