For foreign entrepreneurs:

set up a company in Malaysia

- Trusted by 4000+ Clients in Southeast Asia

- Digital Registration Experience

- 91% of customers recommend us

More Than 20 years of experience

iComSec is the digital corporate secretarial firm that simplifies the processes of incorporating, running and governing a company through an online platform.

WHY iComSec

Simple online company setup for foreigners

with full support

One stop for all requirements

Go digital and paperless on your end

Online registration anytime, anywhere

Assist you with bank account opening

WHO WE HELP

For founders starting

or expanding their business

Solopreneur

We help solo consultants, traders, IT experts, and other professionals easily set up their businesses and enjoy local tax benefits.

Entrepreneurs expanding

Expanding your business to new markets? We help you with local compliance, accounting, and financial reporting setup.

Operating from Malaysia

We help you obtain the right visa to start your foreign business in Malaysia, whether you're here on an Employment or Dependant's Pass, or relocating from abroad

Get Started

Here’s what you need to incorporate a company

Your eligibility as a director

- At least 1 director resides in Malaysia

- Residential address

- Age of 18 and above

- Not bankrupt

Documents needed

- Photocopy of IC

- Consent letter (if your proposed company name is similar to related or associated corporation/ is a trademark / has controlled words)

Download your FREE Doing Business in Malaysia

We’ve put together all of the documents and details you need to figure out before you open a company.

PRICING

Incorporation plans to fit your business

in Malaysia

Incorporation + Consultation

Perfect if you want us to register your business and take care of annual filings with

Incorporation + Consultation

1-on-1 consultation service for establishing a company in Malaysia (60 minutes).

Inclusive of. RM1,050 government fees: name application and registration fee.

Checking the proposed company name for availability

Company name reservation and application

Preparing resolution to open bank account.

Preparing all registration forms.

Preparing 2 sets of certified copies of superform (Sec 14), notification of registration (Sec 15), certificate of incorporation (Sec 17) and notification of first company secretary (Sec 58).

Selected number of resolutions. For example: fix financial record address, appointment 1st auditors' and tax agent, fixing financial year end.

Share certificates and consultation on pre-incorporation matters.

Incorporation + Secretary + Consultation

If you want your first year covered, from company formation to expert support and filing

Incorporation + Secretary + Consultation

1-on-1 consultation service for establishing a company in Malaysia (60 minutes).

RM1,050 government fees: name application and registration fee.

Preparing all registration forms.

Filing with Suruhanjaya Syarikat Malaysia ("SSM").

Minutes of first board meeting.

Resolution for opening first bank account.

Preparing 2 sets of certified copies of superform (Sec 14), notification of registration (Sec 15), certificate of incorporation (Sec 17) and notification of first company secretary (Sec 58).

Selected number of resolutions. For example: fix financial record address, appointment of 1st auditors and tax agent, fixing financial year end.

Share certificates and consultation on pre-incorporation matters.

12-months retainer fees

Incorporation + Secretary

Perfect if you want us to register your business and take care of annual filings with

Consultation + Incorporation + Secretary

1-on-1 consultation service for establishing a company in Malaysia (60 minutes).

RM1,050 government fees: name application and registration fee.

Preparing all registration forms.

Filing with Suruhanjaya Syarikat Malaysia ("SSM").

Minutes of first board meeting.

Resolution for opening first bank account.

Preparing 2 sets of certified copies of superform (Sec 14), notification of registration (Sec 15), certificate of incorporation (Sec 17) and notification of first company secretary (Sec 58).

Selected number of resolutions. For example: fix financial record address, appointment 1st auditors' and tax agent, fixing financial year end.

Common seal, share certificates and consultation on pre-incorporation matters.

Full Compliance

If you want your first year covered, from company formation to expert support and filing

Consultation + Incorporation + Secretary

1-on-1 consultation service for establishing a company in Malaysia (60 minutes).

RM1,050 government fees: name application and registration fee.

Preparing all registration forms.

Filing with Suruhanjaya Syarikat Malaysia ("SSM").

Minutes of first board meeting.

Resolution for opening first bank account.

Preparing 2 sets of certified copies of superform (Sec 14), notification of registration (Sec 15), certificate of incorporation (Sec 17) and notification of first company secretary (Sec 58).

Selected number of resolutions. For example: fix financial record address, appointment of 1st auditors and tax agent, fixing financial year end.

Common seal, share certificates, and consultation on pre-incorporation matters.

Accounting and Tax

Compilation of management accounts.

Yearly Bookkeeping by accountant (< 65 transaction per month / <85 receipts per month)

FREE Autocount Cloud Accounting Software*

Add-ons you might need

Nominee Director - RM6,000 for 6 months

As a foreigner not residing in Malaysia, you cannot establish or manage a business in the country. While you search for the right local partner, we can assist in appointing a qualified nominee local director for your Malaysian company.

Employment Pass (EP) - RM7,000

Upon fulfill of requirement, we will file your CV with relevant professional experience, education data and the company profile to get the visa.

*All the prices above are exclusive of 8% SST

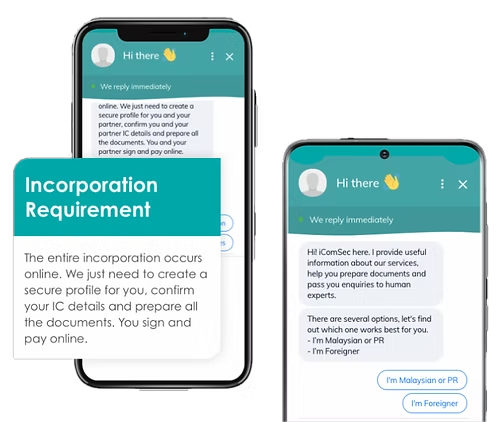

Got questions?

Chat with our local experts

Choose a convenient time to chat with our experts and get the answers you need to take the next step.

Incorporation Process

4 steps for setting up a foreign

company in Malaysia

1. Meet the Official Requirements

We help you handle everything required by Malaysia’s Companies Commission (SSM) for setting up and maintaining your company:

Malaysian law requires every Sdn Bhd to appoint a qualified company secretary licensed by SSM. The secretary handles statutory compliance, prepares and files annual returns, maintains resolutions, updates changes in shareholders/directors, and ensures the company meets all Companies Act requirements.

A Malaysia-registered company must have at least one director who is a Malaysian resident. If founders are foreign, they usually appoint a nominee director. The nominee holds the position legally but does not participate in business decisions. Because directors share legal responsibility for compliance, this service is normally bundled with accounting and compliance support.

Registered address

Every Malaysian company needs a local registered office. This address appears on all official records and is where SSM and government communications are sent. We receive, manage, and forward your statutory mail as part of the service.

2. Get Your Company Set Up and Registered

This includes company name search, director/shareholder submission, digital signing, and preparing all required documents for incorporation. Once approved, you’ll receive your official SSM registration papers and can immediately proceed to banking and operational setup.

3. Open a Business Account

We work with Malaysian banks that offer remote or semi-remote business account opening for foreign-owned companies.

We handle the presentation and documentation, but approval is fully at the bank’s discretion.

Each bank has its own KYC process. Some require a video interview, others may request the director’s presence or couriered documents for verification.

Talk to us for the exact requirements, timelines, and fees for each bank.

4. Set up your accounting calendar

You’ll need to submit several tax and compliance reports every year. Our accounting team organises your documents, prepares your financial statements, and files all submissions correctly. We also guide foreign-owned companies on available tax incentives and compliance requirements in Malaysia.

Even if your company has no transactions, you still must file your annual return with SSM, prepare financial statements, and submit your corporate tax return (Form C). Missing deadlines or incorrect filings can lead to penalties for both the company and its directors.

CONTACT US

Get in touch with us

TESTIMONIALS

What our clients say about iComSec services

Facts & numbers

91%

of customers

recommend iComSec

services

EXCELLENTTrustindex verifies that the original source of the review is Google. Elvina and the Cosec team offered prompt and professional assistance, helping my referral set up a company within days 👍🏻Posted onTrustindex verifies that the original source of the review is Google. They are providing professional service and I would recommended to my friends and customersPosted onTrustindex verifies that the original source of the review is Google. Great experience with iComSec! The team is professional, responsive, and knowledgeable. They made the whole process smooth and efficient. Highly recommended for anyone looking for reliable corporate services.Posted onTrustindex verifies that the original source of the review is Google. Very responsive and provide good advice .Posted onTrustindex verifies that the original source of the review is Google. Had a very pleasant experience with Vivien who helped us set up our company very quickly and is always a message away whenever we need help with administrative matters. Highly recommend VivienPosted onTrustindex verifies that the original source of the review is Google. I want to express my gratitude to Vivian at iComSec for her exceptional assistance during the company incorporation process. Her guidance was invaluable, ensuring a smooth and efficient experience that exceeded my expectations. Vivian's professionalism, attention to detail, and prompt responses truly set her apart. I highly recommend iComSec and Vivian for their outstanding service in company incorporation. Thank you, Vivian!Posted onTrustindex verifies that the original source of the review is Google. Good goodPosted onTrustindex verifies that the original source of the review is Google. Very good service and good advice by miss VivienVerified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more